Some jumbo financial loans: Some jumbo mortgages which can be originated by larger sized banking companies rather than sold to Fannie Mae and Freddie Mac can be assumed. These situations are unusual, having said that, and it can be tough to know which jumbo mortgages are assumable.

When Roam gives comprehensive aid for the idea procedure, it’s encouraged that you work using a educated real estate property agent with regional experience.

Although there are a few worries to navigate, Broesamle thinks the pros can outweigh the Negatives for hopeful customers experience sidelined by large monthly house loan payments.

“It’s an excellent value to make the most of this While using the large interest rates We now have now,” he says. “Because if you can obtain the loan assumed, you realize, you’re intending to help you save on your own as much as fifty% within a rate simply because rates at this time are upwards of seven%. If you're able to take full advantage of that plan, you’re gonna help save by yourself a ton of cash.”

HELOANs offer purchasers the same payment every month and allow them to be aware of their all-in regular cost when purchasing a home. Conversely, a HELOC is a versatile line of credit rating that has a ordinarily variable fascination rate, which you can draw against as essential, but it really’s not frequently utilized for household purchases. Sellers - Getting Started

House loan assumptions come with particular circumstances not existing in new loan originations. Prospective buyers assuming an FHA personal loan will require to maneuver into the house in just 60 days of closing and the house is needed to be their Most important home for a minimum of a person calendar year. But, when buyers presume a VA loan, It is far from expected this be their Key residence.

Though VA loans are created to assistance veterans, active-obligation military customers, as well as their households obtain households with favorable phrases, the customer will not need to be a veteran to presume a VA financial loan.

A shorter bank loan lifestyle As the client, you’ll only be responsible for the remaining many years in the financial loan. So, if the vendor is 8 decades into a 20-12 months home finance loan, you’ll only have the remaining 12 many years to repay.

The vendor’s fairness is the purchase value minus the remaining mortgage stability. This total must be coated in whole by means of an all-income deposit find homes to buy that already have a low interest rate mortgage or by using out a next house loan.

USDA loans The U.S. Division of Agriculture provides these loans to low-money borrowers in rural places, and new borrowers should meet precisely the same credit rating score and income conditions.

It’s recommended to refer to with all your lender for a detailed breakdown of the costs connected to mortgage assumption.

Once the home finance loan is efficiently transferred, your identify is going to be removed from the house loan. You are going to no longer be held liable or connected to the home loan. Just about anything that occurs with the house loan following the belief could have no impact on you or your credit rating.

Roam’s Protection Program is intended to assure sellers are more receptive to assumption gives, figuring out These are included Should the timeline is delayed. It also offers extra negotiating area and may help improve your present in a multiple-supply condition when it takes place.

We’ll get the job done with all your listing agent to market your listing to consumers keen on assuming a small-rate mortgage. We also can give your agent with more marketing sources to include using your listing.

Tia Carrere Then & Now!

Tia Carrere Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Tina Louise Then & Now!

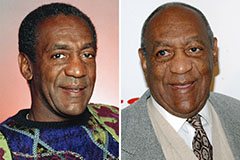

Tina Louise Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!